Owner Earnings

— December 5, 2014“Owner earnings” is a concept made popular by Warren Buffet through his letters to the shareholders of Berkshire Hathaway. Most investors focus on the reported earnings or earnings per share (EPS). One of the popular ratios for valuing a business is P/E, which relies on the relationship between the reported earnings or EPS and the price of the stock in the market to determine if a stock is expensive or cheap relative to other companies in the industry and the market in general. Ratios like P/E make the valuation of business sound simple but can result in huge errors of omission.

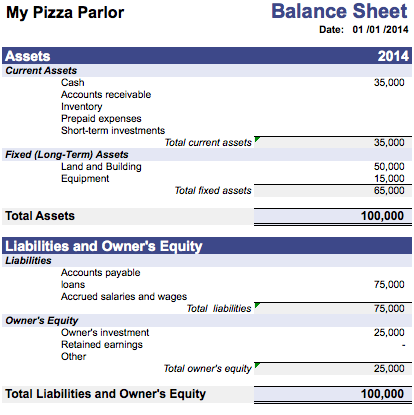

Imagine you are the owner of a pizza parlor in your neighborhood. As a business you need equipment and you have liabilities, sales and expenses such as utility bills and salaries for your employees. Lets assume you put in capital of $25,000 and took out a loan of $75,000 to open your pizza parlor.The day you open your pizza parlor for business your balance sheet will look like this.

After a year of operation you would have sold many pizzas to happy customers,generated revenue and created employment in your community. Lets imagine your revenue at the end of the year was $200,000. You paid $80,000 in salaries, $25,000 for ingredients or raw material, $8000 in electricity bills, and $2,000 in other utilities and miscellaneous expenses. Hence your gross profit would be $85,000 after deducting all expenses and your net earnings before taxes would be $79,060.36 after deducting interest expense.

While reporting your earnings to IRS you are allowed to decrease the book value of a non-current asset (tangible) by recognizing an operating expense on the income statement, also known as depreciation. Depreciation helps reduce your taxable income or earnings. IRS provide guidelines on depreciation schedule for different types of assets. We have two types of assets in the pizza parlor. 1. The building – depreciated over 15 years and 2. Equipments depreciated over 7 years. The earnings after depreciation for the pizza parlor would be $73584.17.

However as the owner of the pizza parlor the cash your business generates after all expenses is different from what you report to IRS. The cash flowing into the business regardless of what is reported to IRS is known as Cash Flow.

As you can see from the example of a Pizza parlor there are many interpretation of earnings. The same is true for public companies listed on the stock market. When companies report their earnings they are complying with the accounting standards set by FASB also know as GAAP or General Accepted Accounting Principles.

Warren Buffet introduced the term Owners Earnings in his 1986 letter to shareholders to accurately assess the earnings as the owner of the business. He defined Owners earnings as follows:

Owner Earnings is (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges…less (c) the average annual amount of capitalized expenditures forplant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume….

He further states

Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since (c) must be a guess – and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes…All of this points up the absurdity of the ‘cash flow‘ numbers that are often set forth in Wall Street reports. These numbers routinely include (a) plus (b) – but do not subtract (c).

GAAP based earnings and cash flow sacrifice accuracy for precision and hence misleading. If you are the sole owner of a business you understand the difference between the capital expenditure that is needed to maintain your business and the expenditure that you would employ to expand your operations, hence revenue and earnings. This is the gist of Owners earnings.

The definition provided by Warren Buffet regarding Owners earnings is regarded as the holy grail in understanding the true potential of a company’s earning power, however there is a subtle omission or lack of clarity that was highlighted by Prof Sanjay Bakshi in a recent twitter conversation on Owners earnings.He explains

Mr. Buffett started from reported earnings and then made adjustments to arrive at owner earnings. He did not adjust for outlays having a quasi-capes nature such as advertisements or research & development, which had been treated as an expense in the P&L before arriving at reported earnings. So, the first variable (reported earnings) in his equation is likely to be depressed in some situations.

Conclusion

Ben Graham advised investors to treat stocks as part ownership in the underlying business in his popular book “The Intelligent Investor” and Owners earnings one of the key concepts that helps an investor in understanding the fundamentals of a business. As Warren Buffet wrote in his letter to shareholders it’s important to understand what is behind the numbers to grasp the true earning power of a business. I end this post with an excerpt from his letter to the shareholders of Berkshire Hathaway

Questioning GAAP figures may seem impious to some. After all, what are we paying the accountants for if it is not to deliver us the “truth” about our business. But the accountants’ job is to record, not to evaluate. The evaluation job falls to investors and managers. Accounting numbers, of course, are the language of business and as such are of enormous help to anyone evaluating the worth of a business and tracking its progress. Charlie and I would be lost without these numbers: they invariably are the starting point for us in evaluating our own businesses and those of others. Managers and owners need to remember, however, that accounting is but an aid to business thinking, never a substitute for it.

Preston Pysh at Buffettsbooks.com has a great tutorial on Owner Earnings. Check it out.

Leave a reply