IBM’s Big Blues: Will the elephant dance ?

— December 2, 2015 A lot has been written about IBM recently in the media. Critiques of the Big Blue are increasing with every disappointing quarter. In this post I try to explore the business model of IBM and the headwinds it is facing today. I also introduce you to the company’s history and culture, based on my research and my experience at the company as an intern back in 2001. This is not a buy or sell recommendation for IBM stock. The focus is on understanding the company and its business model. I trust you will do your own research before you decide to trade shares of IBM.

A lot has been written about IBM recently in the media. Critiques of the Big Blue are increasing with every disappointing quarter. In this post I try to explore the business model of IBM and the headwinds it is facing today. I also introduce you to the company’s history and culture, based on my research and my experience at the company as an intern back in 2001. This is not a buy or sell recommendation for IBM stock. The focus is on understanding the company and its business model. I trust you will do your own research before you decide to trade shares of IBM.

IBM at a cross roads

Silicon Valley and Wall Street consider IBM irrelevant in today’s technology landscape. The media is fascinated by Amazon and Google. IBM is discussed in the media when it announces a disappointing quarter or makes billion-dollar acquisitions. Based on my research, here are some of the top reasons for the pessimistic view of the Big Blue.

- Declining revenue over many quarters (14, to be exact).

- IBM has come late to the cloud party and is ineffective in handling emerging threats from Amazon and Microsoft .

- Lack of confidence in management’s vision and execution, specifically capital allocation.

- Suspicion of IBM’s share buybacks and increasing earnings per share through financial engineering.

- Low investment in R&D and resulting lack of innovation in the past decade.

- The startups of today will be the Fortune 500s of tomorrow, but they are embracing Amazon Web Services and Salesforce, not IBM.

Everyone has suggestions and advice about how IBM can get back on its feet and recover from the malaise of declining revenue and join the growth camp again. Listen to Jim Cramer’s advice to IBM on his show “Mad Money.”

History doesn’t repeat itself, but it does rhyme

I recently read the book “Big Blues: The Unmaking of IBM” by Paul Carroll, published in 1993. This was an era when IBM was going through one of its worst existential crises. Lou Gerstner, who is credited with its transformation, had just joined the company as CEO. The book paints a dire picture of a giant in decline. The author outlines the decisions, mistakes and culture that were responsible for the unmaking of IBM. The following paragraph from the book summarizes the opinion of the author about the state of IBM during the early 1990’s:

The tough part about chronicling IBM’s problem is that IBM was once such a great company — great to its customers, great to its shareholders, great to its employees, great to the towns, cities, states, and countries where it operated. In many people’s eyes, IBM wasn’t so much a company as an institution. Yet the things that made the company so widely admired are what now make it vilified. People once referred to IBM’s passion for being right, its rigorous processes, its thorough training of employees, its focus on customers’ desires, its guarantee of lifetime employment. But the computer industry has moved out of the horse-and-buggy days that produced IBM’s values and into a relativistic universe where everything is moving at the speed of light. So, referring to the same values IBM has always had, people talk about IBM’s fear of risk, its civil-service mentality, its brainwashing of employees, its failure to make innovative products that anticipate customers’ desires, its inability to adapt its work force quickly enough to react to shifts in the industry. What follows, then is a sort of Greek tragedy. It is a very sad story

We now have the advantage of hindsight, and today we know how IBM transformed itself from a hardware-centric company with the majority of its revenue coming from mainframes to an enterprise solutions company with diversified revenue from hardware, software and services. Lou Gerstner has chronicled his experience at IBM and his efforts to transform the Big Blue in his book “Who Says Elephants Can’t Dance?: Leading a great Enterprise through Dramatic Change”

Gerstner was a customer of IBM before he joined the company as its CEO. He had purchased mainframes and other products from IBM and interacted with its sales force during his tenure as executive vice president at American Express and later as chairman and CEO of RJR Nabisco. Being a consumer of enterprise technology, Gerstner didn’t have to try hard to understand IBM’s customers, he had been one of them just months before he became CEO of the Big Blue. In hindsight, he was the right person for the job. His big bet was that customers value solution providers and integrators more than hardware vendors; they want someone to help them solve problems, not just give them tools to do it themselves.

Lou Gerstner’s insight: Customers value solution providers and integrators.

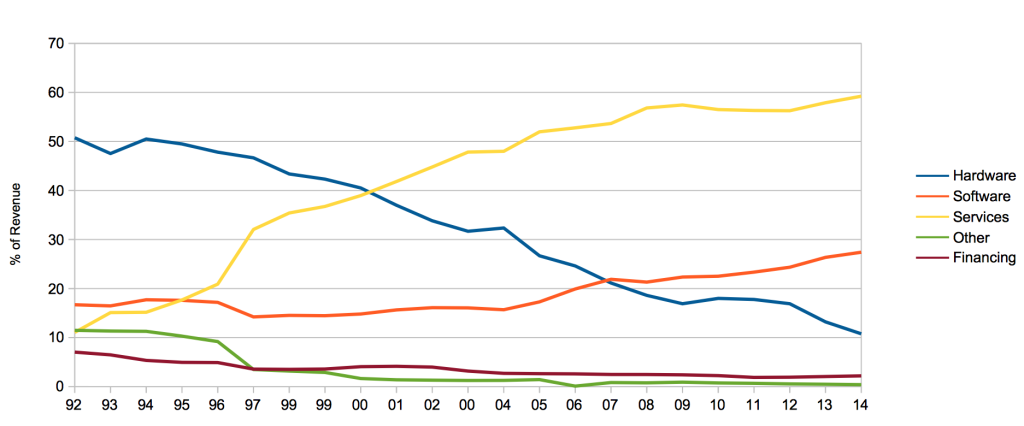

Gerstner’s vision for IBM was to transform the company into a solutions company, which meant a focus on software and services and less emphasis on hardware. When Gerstner stepped down as the chairman and CEO in 2001, IBM generated 15.1% of its revenue from software, 38.9% from hardware, 40.7% from services and 4% from financing activities. The chart below illustrates the shift in IBM’s revenue mix over the past two decades.

source : IBM’s annual reports

Today IBM is caught in the midst of many disruptive trends that could change enterprise IT in a significant way. Ginni Rometty, the current CEO of IBM, has identified these trends as: the cloud; mobile; analytics; and security. She says that she has been selling businesses that are not aligned with the roadmap toward new industry trends and those that are not profitable.

Ginni Rometty’s insight : Data is the new oil.

Creative disruption is not new to the IT industry and IBM. Back in the 1950s, Remington Rand Corp. had forged so far ahead that the general public referred to computers as Univacs, after the name of their machine. In his book “The Unmaking of Big Blue,” Carroll describes the birth of IBM mainframes:

Tom Watson Jr, then CEO of IBM, took what Fortune magazine called “the $5 billion gamble” in the early 1960s — that was about three times IBM’s revenue at the time. The gamble, a bigger undertaking than the Manhattan Project, which produced the atomic bomb, was designed to produce a whole new line of mainframes, called the 360.The project was even more daring than the mere cost would indicate, because IBM under Watson did something that it has never tried since: Rather than trying to protect the existing product line from the effects of the 360, IBM tried to use the 360 to wipe out all current products, including IBM’s flagship computers. – page 52

The project got off to a shaky start in 1965 and was plagued by software issues and delays, but once the issues were resolved, the 360s were a huge success and took IBM from 25% to 70% market share of the computer industry.

The mainframes were ahead of their time; they adopted integrated circuits rather than vacuum tubes unlike many of the competitors. Integrated circuits were more reliable and efficient than vacuum tubes and needed less space. As Gordon Moore would later postulate, their cost would decline rapidly following the now-famous Moore’s law.

Watson Jr’s insight : Integrated circuits are the future of computing.

Bumpy road ahead ?

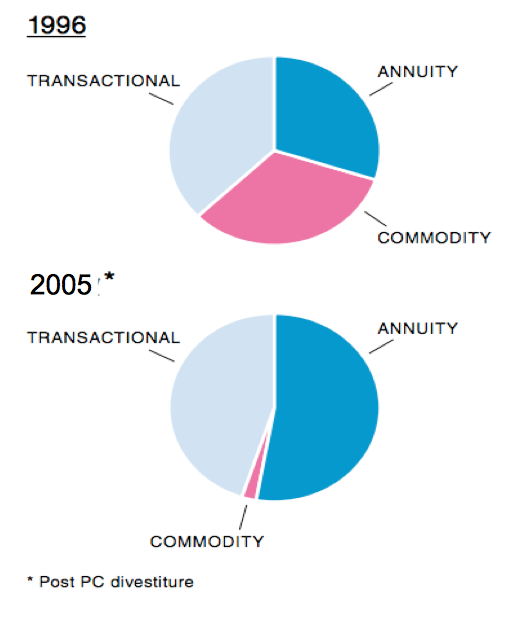

Today IBM again finds itself amidst shifting trends in the IT industry. The Big Blue had been executing the vision and roadmap set by Lou Gerstner and later strengthened by Sam Palmisano by gradually moving away from commodity business with low returns toward software and services with higher returns. Management was confident of its ability to execute on its plan. In the 2010 annual report, Palmisano provided an earnings roadmap with a target of achieving an EPS of $20 by 2015. This confidence was well-placed and based on a solid backlog of orders as IBM’s revenue shifted toward annuity-based contracts. The charts below illustrate the transformation achieved by Gerstner and Palmisano by the end of his tenure, which was reflected in the revenue mix by the end of 2005.

source : IBM 2005 annual report

Warren Buffett announced his investment of $10.7 billion in IBM at the end of 3rd quarter 2011. He was impressed by the reliability of the company’s earnings and its track record. He explained his decision to invest in IBM in an interview with Becky Quick of CNBC.

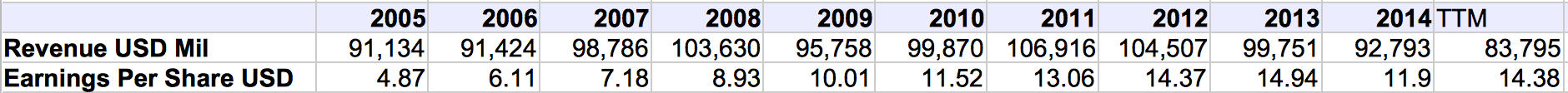

However, in 2012 IBM reported a decline in revenue for the first time in recent years. the company has continued to disappoint the street year after year ever since. The table below shows IBM’s revenue and EPS over the past 10 years. At this time, IBM is facing several headwinds all at the same time.

Cloud on the Horizon

The cloud has been on IBM’s radar for the past few years, but the company did not anticipate the disruption this would cause in the industry. Amazon emerged as a formidable competitor to IBM. Today there are many players in the cloud, including Amazon, Microsoft and Oracle. Each has their own unique value proposition and they compete in different areas of the cloud: Infrastructure as a Service (IaaS); Platform as a Service (PaaS); and Software as a Service (SaaS).

IBM came up with its own cloud offering and called it “Smart Cloud.” IBM’s strength is in hybrid cloud with a focus on PaaS; however, the company underestimated the demand for public cloud and Amazon’s public cloud offering. Amazon Web Service grew exponentially in popularity and market share. IBM acquired SoftLayer, one of Amazon’s competitors in public cloud, to complete its offering.

IBM is trying to establish itself as a major player in the cloud computing market with two investments: expansion of SoftLayer’s data center footprint around the world; and development and expansion of Bluemix, IBM’s PaaS

IBM is #3 in IaaS with 12% of market share, #6 in SaaS with 3% of market share, and #4 in PaaS with 4% of market share. Overall IBM was #4 among cloud providers in Q4 2014 as per wikibon

Big data and big hopes ?

A big bet for IBM and Rometty is big data. She calls data the new oil and has invested significantly in the area of big data analytics. Watson is IBM’s flagship product in this area; it became famous for winning Jeopardy in 2011.

IBM Watson is a technology platform that uses natural language processing and machine learning to reveal insights from large amounts of unstructured data.

In January 2014, IBM established Watson Group, a new business unit dedicated to the development and commercialization of cloud-delivered cognitive innovations.

IBM plans to invest more than $1 billion in the Watson Group, focusing on research and development and bringing cloud-delivered cognitive applications and services to market. This will include $100 million for venture investments to support IBM’s recently launched ecosystem of startups and businesses that are building a new class of cognitive apps powered by Watson in the IBM Watson Developers Cloud.

source : IBM

Ginni Rometty at IBM Watson Group Launch Even, New York

Losing empty calories

Even though revenue and profit from strategic imperatives have been growing at a healthy rate over the past few years, they haven’t offset the decline in revenue in core services. However, it must be noted here that the declining revenue in some of the core services is by design.

We completed or announced the divestiture of three businesses in 2014 that a year earlier drove $7 billion in revenue, but lost about $500 million in profit — what I call empty calories. – Ginni Rometty

During the Morgan Stanley Technology, Media & Telecommunications Conference in March 2015, IBM stated that it plans to invest $4 billion in key strategic areas: the cloud, big data analytics, enterprise mobile, and security. The company expects these growth areas to increase from $25 billion in 2014 to over $40 billion by 2018. As of now, these areas contribute 27% to overall revenues, though the company expects them to make up 40% of overall revenues by 2018.

source : marketrealist.com

While IBM partly hedges currency risks by having employee and operations outside U.S, the strong dollar has affected the company’s sales by 9 percentage points year over year, as reflected in the third quarter of 2015 (that is almost a tenth of all sales).

source : seekingalpha.com

Is IBM still relevant?

IBM was founded on June 16, 1911. In the past 100 years it has faced many challenges and existential threats. The company has successfully transformed itself many times. Today it is facing a transformational moment. Even though the current environment in the IT industry doesn’t pose an existential threat to IBM’s business model, if the company fails to adapt and execute on its strategic initiatives, it might risk losing its place as a dominant player.

IBM is considered a dinosaur in the industry. Its bureaucracy is infamous for stifling innovation and driving out talented engineers. IBM is not the first choice for engineers graduating from top universities. The IT industry owes much of its innovation and to some extent its existence to IBM, but the company is not considered the center of innovation anymore.

Google, Amazon and Microsoft are considered the dominant players in the industry, with 2 to 5 times the market capitalization of IBM. They didn’t even exist few decades ago.

Creative destruction is an essential part of capitalist economies. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq Stock Market. The history of the Dow Jones Industrial Average is a history of the U.S. economy, and the roster continues to reflect its ongoing evolution The Dow roster will look very different in 25 years. Of the 30 current stocks, fewer than half were members in 1989. Only five have maintained membership for 50 years; IBM is one of the survivors.

Like CEOs before her, Rometty has a vision for IBM and a plan to navigate through the tectonic shifts in the IT industry today. If she succeeds, IBM will be significantly different in the next decade and might still play an important role in shaping the future

5 Comments

Thank you for the great article Harry.

Wonderful, informative article. Well written and easily understood, it reminds me of how Buffett seeks to have a journalist’s mindset and create a “story” when evaluating a company.

You have laid out the key points in a succinct and intelligent manner.

Very well done Hari.

Thanks for the kind words Mary, appreciate your feedback

Hi Hari, This is great article about the future of data computing and IBM business in this area. Also it remembers me about the Start track movie..still we are in the dream to make these cognitive machines.

Machine learning is depending on the data input, if these machines get good input and it can learn like a kid, that leads to cognitive intelligence which can be great use for us.

This is start for IBM in the race, there are already few major companies are already in the business. As you said, it can change the business landscape in cognitive intelligence development.

I also see these is a great opportunity for the more business with IBM Watson application.

Jim Cramer’s said to acquire few companies that can fit into IBM business model. What do you think about the IBM acquisition strategy now ?

Thank you for this great article.

Satya, Thanks for your kind words. 90% of world’s data generated over last two years, information use to be an advantage but with the information overload today – insight is critical, IBM and many other companies are trying to address this need. IBM’s watson is one of the leading products in this area. Regarding acquisition IBM has had a mixed results in terms of acquisition but they always been disciplined in my opinion, though not fast enough. I believe their acquisitions are part of their plan to transform their business towards their strategic initiative (i.e. Cloud, Analytics, Mobile and Security ). I hope this answers your question.