The Markel Style

— July 18, 2015Markel Corporation is a financial holding company whose principal business is specialty and property-casualty insurance. Markel is also known as Baby Berkshire; the company has tried to replicate the Berkshire Hathaway formula for success in the insurance business for many years.

Markel holds a brunch, the day after the Berkshire Hathaway annual shareholders meeting. I attended the brunch this year. The meeting was casual.It was a entertaining and educational and a great way to experience the culture of Markel. Tom Gaynerand Steve Markel along with CFO,Anne G. Waleski and COO,Richard R. Whitt were on the stage.

I have been following Markel for some time. In this post I share my notes on the company, including my notes from the brunch meeting in Omaha on May 2, 2015.

Please note: This post is not a recommendation to buy shares in Markel Corporation.

About Markel

Markel was founded in 1930 and with its head quarter in Richmond Virginia. It began by writing insurance for makeshift taxi-cabs in Virginia. The company grew along with the transportation industry.

Markel was founded in 1930 and with its head quarter in Richmond Virginia. It began by writing insurance for makeshift taxi-cabs in Virginia. The company grew along with the transportation industry.

Markel went public in 1986 with an initial public offering valuing the company at $35 million . Today Markel’s market cap is $10.7 billion with a share price of $878

Markel’s strategy focuses primarily on specialty insurance, which is subject to less competition and regulation. The company attempts to achieve pricing power through specialized market knowledge

Markel’s Insurance Businesses

Markel is an insurance company, and its insurance businesses account for most of its revenue and profits. Markel operates in the following segments of the insurance industry

- Markel Specialty Insurance : Provides insurance programs tailored to meet the needs of specific segments of the marketplace, including professional liability, property, trade credit, and marine coverage

- Markel Wholesale Insurance : Specializes in products that are not available to customers through standard markets. These products are distributed through wholesale partners and include over 15 lines of business.

- Markel International : Headquartered in London, Markel International operates in UK, Europe, Canada, Latin America, and the Asia-Pacific region. Their product portfolio includes equine and livestock, marine and energy, professional liability, and trade credit coverage.

- Markel Reinsurance : Reinsurance is insurance that is purchased by an insurance company from one or more insurance companies (the “reinsurer“) directly or through a broker as a means of risk management. Markel offers property, casualty and specialty reinsurance products through the broker market

Markel’s Non-insurance Business

- Markel Ventures : Makes permanent investments in businesses other than insurance.These are fully owned subsidiaries; revenues from Markel Ventures was $883 million in 2014, up from $710 million in 2013 and $539 million in 2012.

- Markel-Gayner Asset Management Corp : Equity portfolio managed by Tom Gayner. Top 5 securities in the portfolio include :

| Position | % of Portfolio |

| CarMax Inc | 8.57 |

| Berkshire Hathaway Inc | 10.5 |

| Walgreens Boots Alliance Inc | 4.57 |

| Brookfield Asset Management Inc | 4.5 |

| Walt Disney Co | 4 |

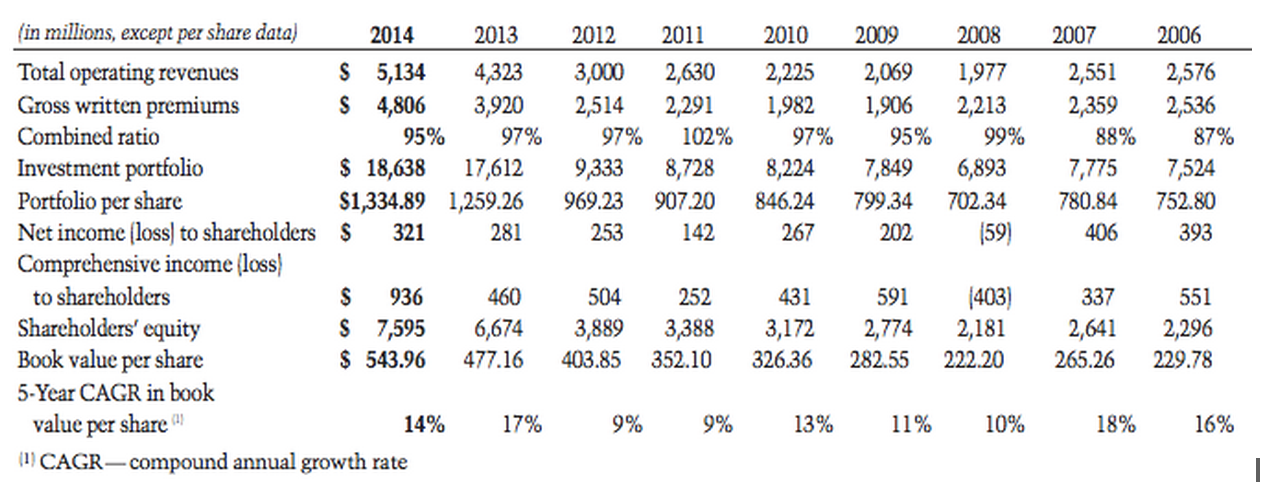

Financial History

The Markel Way

- (Notes from the annual meetings and letters to shareholders)

On Underwriting Discipline :

A disciplined underwriting approach is critical to our success so we expect our results to be cyclical due to the nature of the insurance industry. The business of insurance is to help others generate smooth results; we expect our ride to be bumpy. We know hurricanes will happen, but we don’t know when. The same applies to our investment returns in the short run. So we measure our performance in rolling 5 year periods.

The Markel Style :

If you need an insurance product and you want to get it quickly and easily, Markel does not do that. We insure things that are complicated and/or special situations such as kid’s summer camps, large boats, wedding/event cancellations, vacant properties, new medical devices and new technology adoptions.In short underwriting specialty insurance involves the same process as investing. It’s important to understand the risks and have people who specialize in those areas.

On Risk Management :

We have a conservative approach to leverage. We have a policy of one-third equity and two-thirds debt to help us manage risks and limit our financial leverage.

A key element in evaluating insurance risks is thinking about moral hazards. We don’t want our insurance policies to create incentives for our insureds to have losses. So we don’t insure $100,000 horses for a million dollars. On the contrary, we want our clients (the insureds) to have interests in their properties to be closely aligned with ours.

On Business Performance & Growth :

We believe book value is the best measure of performance. Our goal is to compound BV over the long term. So far we have compounded BV at an annual compound rate of 14% over the past 5 years

Insurance premium volume in the US is $500 billion and over $1 trillion worldwide, Markel’s gross premium volume is $4.8 billion and has room to grow. We will continue to invest and expand our insurance and non-insurance businesses profitably

On Markel Culture :

Compensation plan : No use of stock options, yet a significant number of employees own stocks, which are mostly acquired in open markets.

On Shareholders : At Markel our shareholders are our friends, families, institutions we admire and ourselves.

On Investing at Markel (Steve Markel) :

Type of investments :

- Fixed income : Any investment where we expect to get our money back in a specified period with interest.

- Equity : Our returns are the residual ownership returns, carrying no explicit promises. We usually have an infinite time horizon for our equity investments.

Sources of funds (float) and investment allocation strategy :

- Loss reserves – These are what we will ultimately owe to our clients if claims become due. This money is invested in high- quality fixed income securities with matching maturity dates, and we hope to earn a positive spread. Over time we have earned a healthy underwriting profit

- Shareholders equity – If we underwrite our insurance policies profitably and account for it conservatively, these funds are ours forever. They can be invested with an infinite time horizon, which is equities.

The Four Filters for Investing at Markel :

- Businesses that are profitable and earn good returns on capital ( i.e. ROIC not ROE ); demonstrated record of profitability

- Management has equal measures of talent and integrity, one without the other is useless.

- Businesses with the best ( or good ) Reinvestment dynamics

- A great business is a compounding machine; a business that makes good returns on its capital and can maintain the same or higher returns over a long period and this is a rare case.

- A good business is a business that makes good returns on its capital, but can’t reinvest the capital at high returns. We expect the returns to come from dividends.

- A worst business is one that has low ROIC and needs a lot of capital just to maintain the business.

- Price : A fair price is one that allows me to earn the same return on capital that the business intrinsically earns.

2 Comments

Markel is an impressive insurance and diverse holding company and definitly has some merit to the Berkshire comparison!

They have had outstanding long term results, and I agree with your assessment above. Somethings that have kept me on the sideline of insurance this year have been the competition for capital currently, with many hedge funds and new providers entering the market with looser underwriting standards especially in the re-insurance industry.

A few items I would have to wrap my head around would have nothing to do with the business operations but the price it is currently trading at running at a premium in both earnings and book value to it’s norm and within the industry.

The 25x P/E it currently trades at an 33x future PE make it a tougher pill to swallow with the challenges the RE-Insurance industry will face and this is roughly a quarter of Markels business.

The book value of 1.5 is not to out of line but historically trades around 1.25, the possible danger to this is the 10 billion in fixed income securities they currently hold, when interest rates rise the book value of these will be substantially reduced.

Markel is no doubt an A1 company on all fronts and any longtime shareholder has been well taken care of, I would be curious to hear your take on how you feel they are currently priced.

Nick, I agree with your observation regarding the valuation. Markel is a insurance business, unlike Berkshire most of their revenue is from their insurance and investment operations. Markel is in the business of protecting their clients against uncertainties ( or Black Swans). Key concerns at this time are (1) The returns Markel can earn on its investments considering the market conditions (2) The profitability of insurance underwriting considering the insurance market (3) The uncertainty in re-insurance business, specially the super cats.