Barbell for Life

— April 12, 2021A Barbell is an exercise equipment used in weight training consisting of long bars with weights attached at each end.

Barbell strategy is one of the several strategies used by investors and traders to manage risks in their portfolios while maximizing returns. The strategy resembles the configuration of a barbell i.e. emphasis on extremes at the ends while low or no allocation of capital or risk in the middle.

According to Investopedia

The barbell strategy is an investment concept that suggests that the best way to strike a balance between reward and risk is to invest in the two extremes of high risk and no risk assets while avoiding middle-of-the-road choices.

Barbell strategy in risk management was made popular by Nassim Taleb who is the author of popular business books such as “The Black Swan” and “Fooled by Randomness”.

In his books, Taleb is an advocate of the barbell investing approach. Having found great success as a trader, Taleb profited several times throughout his life on market downturns when most investors were taking losses, reportedly profiting during the 2008 financial crisis from the implementation of a barbell investing strategy. Funds operated by Taleb gained as much as 115% during the financial crisis by utilizing barbell strategies.

In several conversations with one of my friends, we have explored the application of this strategy to life and work. During those conversations, we uncovered how we had stumbled upon this strategy inadvertently in our careers. If we are deliberate and mindful I believe this strategy can pay huge dividends in Career and life. I am sharing some of the key insights I have gained through our conversations. I hope you find this useful. I look forward to learning from your comments and thoughts.

Assumptions:

I make a few assumptions here. I am from a middle family, I started my career with little financial cushion or resources, hence I assume similar circumstances while sharing my recommendations.

Phase #1 of your career

You have just completed your education, a bachelor’s or master’s degree in your field of interest and now you are looking for opportunities. This is the phase of your life when you have little or no financial resources but are time rich and little or no financial or social obligations. You have the energy and ambition to maximize your potential.

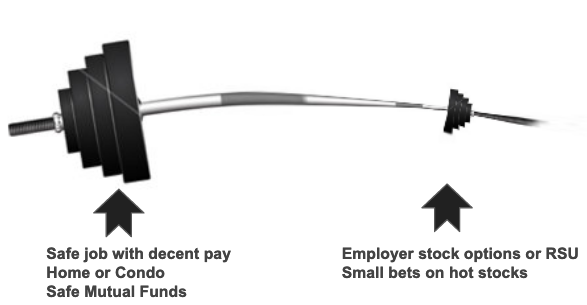

The conventional wisdom would nudge you towards getting a secure and well-paying job so you can build a secure future, you are also advised to buy a condo or home as soon as you can save the down payment and invest regularly in safe and sound investment vehicles such as mutual funds.

Conventional advice looks like this if viewed thru the lens of a Barbell strategy

By choosing to follow the conventional wisdom you are over-indexing on safety in the short to medium term and sacrificing the growth in the long term.

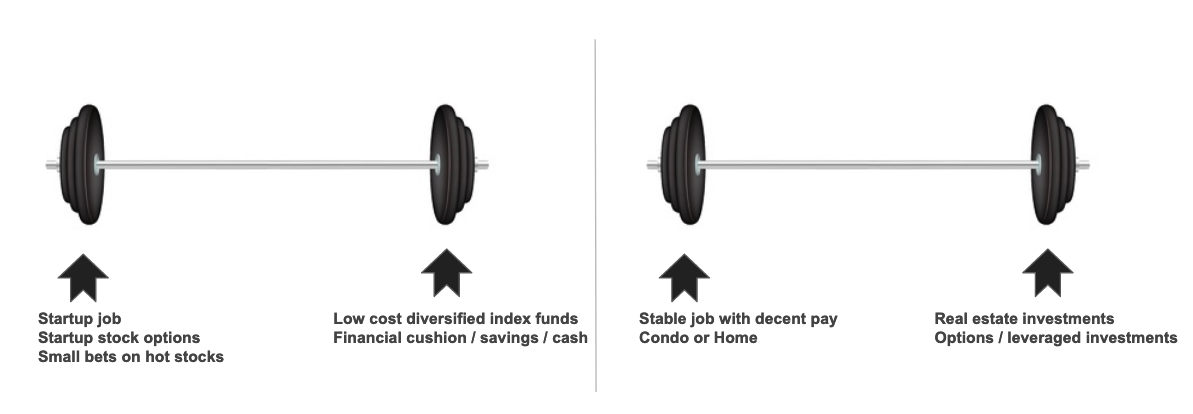

If you were to follow a Barbell strategy at this phase of your career, your choices would look like one of these.

The key takeaway here is to develop a better understanding of risk and use it carefully as part of a long-term strategy towards your goals.

Note: Working at a startup has a high-risk reward profile both for your finances and career, however when you are starting out the downside is limited as you have a long runway in your career to make up for the lost time in terms of career growth and your retirement savings. On the upside it can boost your career growth while providing you with significant financial security and flexibility.

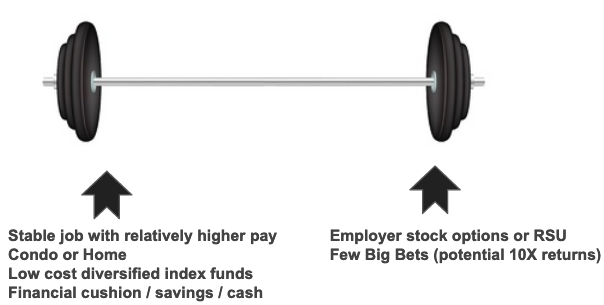

Phase #2 Mid Career

Assuming you have chosen to apply the Barbell strategy in the early phase of your career, you either will have a moderate to significant savings / net worth 10+ years into your career. At this stage of your career, you are relatively time poor as you might have family and social responsibilities, this limits your ability to take risks and invest the time at will. If you are in this situation then your Barbell would look something similar to the one below.

The goal at this phase of your career is to avoid anything that will come in the way of the compounding you have set in motion. The compounding is not limited to your net worth but also applies to your experience, skills, network, reputation, family, health, wellbeing, and goodwill.

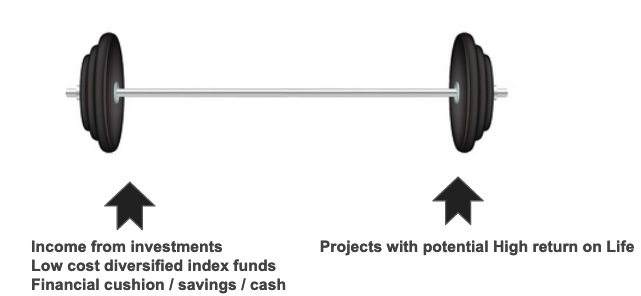

Phase #3 Trailblazing in Twilight

If you have followed my recommendations in the previous phases, you have a high likelihood of being financially independent at 15-20 years into your career. By this time you have the financial flexibility and gained back time as you have grown out of some of the responsibilities that placed a high demand on your time and energy at home. As your net worth and financial security grow along with your age and experience in life, chances are your perspective about life too will change. This is a phase of life where you might value meaning over money (assuming you have sufficient money in the bank). You now have the luxury to finally scratch an itch or pursue a passion you always wanted to but did not have the luxury to commit time and effort. The key to success in this phase is to ensure you are secure and resilient but more importantly have the courage to break away from the fear of uncertainty. A Barbell strategy at this phase of your life and career might look something like this.

Leave a reply