Dhandho Holdings and Pabrai Funds Annual Meeting – 2015

— September 23, 2015This past weekend I was in Irvine to attend the annual meeting of Dhandho Holdings and Pabrai Funds. The number of people attending the meeting has grown over the years. Mohnish Pabrai is a great host, he takes time to meet the attendees before the meeting. Dinner is served after the meeting and is a great opportunity to meet and connect with other attendees.

The format of the meeting was similar to last year. The meeting started with a presentation where Pabrai shared his thoughts on markets and current economic condition. He later reviewed the performance of Pabrai funds, followed by postmortem of some of the recent investments and finally answered questions from the audience.

Meeting Notes :

Pabrai started the meeting with a Fiat Ad , Fiat Chrysler Automobiles is one of the top holdings in Pabrai Funds.

A brief history of booms and bursts in the past century.

Bubble in the Automobile Industry ( 1918 – 1921 )

The period from 1920-29 is often called the ‘Roaring Twenties’. The First World War had been good for American business. Factory production had risen sharply to meet the needs of the war. America had captured markets that used to buy from Europe. These countries continued to buy American goods even after war was over.

The greatest boom took place in the motor car industry.Car production consumed 20% of America’s steel, 80% of the rubber produced, 75% of plate glass, and 65% of leather produced. The more cars that were made, the more jobs that there were created in these industries. By the end of the 1920s American cars used seven billion gallons of petrol a year. This helped to create jobs in the oil industry and construction industry.

At the peak of the boom there were more than 100 auto companies, however by and of 1920, there were 3 car manufactures in the U.S. a 97% decline.

reference – gcsehistory.org.uk

Bubble in Electronic Industry (1958 – 1961)

During the 1950’s anything “Tronics” was highly valued. The semiconductor industry was transformational and impacted many industries. Investors flocked to fund many startups during the 50’s, however by 1962 more than 90% of these companies did not exist.

The Dot Com Bubble ( 1998 – 2000 )

The period was marked by the founding (and, in many cases, spectacular failure) of several new Internet-based companies commonly referred to as dot-coms. Companies could cause their stock prices to increase by simply adding an “e-” prefix to their name or a “.com” to the end.

The collapse of the bubble took place during 1999–2001. Some companies, such as pets.com, failed completely. Others lost a large portion of their market capitalization but remained stable and profitable, e.g., Cisco, whose stock declined by 86%. Some later recovered and surpassed their dot-com-bubble peaks, e.g., eBay.com, Amazon.com whose stock went from 107 to 7 dollars per share.The Nasdaq Composite lost 78% of its value as it fell from 5046.86 to 1114.11 in few short months.

All booms have a kernel of truth, in other words there is a sensible story. The bubble builds as the market provides positive reinforcement to some investors and businesses for irrational or ill-thought out actions.

reference – wikipedia.org

History doesn’t repeat itself, but it does rhyme Mark Twain

The reoccurrence of bubbles every 40 years might not be a coincidence, as a generation of investors who experienced a crash fade away new generation of investors take their place and when the next bubble forms, they might think “this time its different”

Nifty-Fifty returns ?

Nifty Fifty refers to the 50 popular large-cap stocks on the New York Stock Exchange in the 1960s and 1970s that were widely regarded as solid buy and hold growth stocks.

The fifty are credited with propelling the bull market of the early 1970s. Most are still solid performers, although a few, especially technology companies are now defunct or otherwise worthless.

The long bear market of the 1970s that lasted until 1982 caused valuations of the nifty fifty to fall to low levels along with the rest of the market, with most of these stocks under-performing the broader market averages.

In the 1960’s and 70’s there was a one dimensional market,with the Nifty-Fifty stocks attracting disproportionate amount of capital resulting in a two tired market. This was evident by the high price to earnings (PE) ratios of some of the Nifty Fifty companies during the 60’s 70’s.

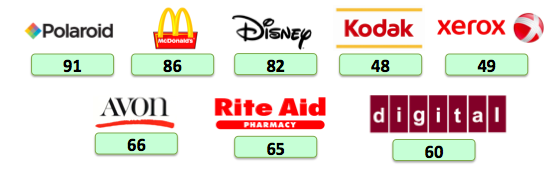

During 1972-1974 many of these stocks had a steep decline in their price to earnings (PE) ratios and stock prices. For example Poloroid’s stock fell by 91%, Avon by 86%, Disney by 75% and Xerox by 71%.

PE ratio of some of the Nifty-Fifty companies today :

- McDonald’s (MCD) – 22

- The Walt Disney Company (DIS) – 21.5

- Xerox Corporation (XRX) – 18

- Rite Aid Corporation (RAD) – 3.7

- Avon Products (AVP) – negative earnings

- Eastman Kodak (KODK) – Emerged from bankruptcy on Sep 3rd 2013. Negative earnings.

- Digital Equipment Corporation – Acquired by Compaq, after divestiture of major assets.

- Poloroid Corporation – Filed for chapter 11 in 2001

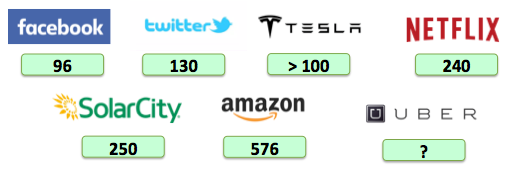

Today we might be reliving the Nifty-Fifty high valuation for some of the growth companies while stocks of many sound businesses on the indexes languish. A quick look at theprice to earnings (PE) ratios of some of the super stars in todays market will illustrate the point.

It’s always hard to identify a bubble, however there are some measures like price to earnings (PE) ratios that can provide signals. During the dot-com bubble ( in 2000) there were 120 companies withprice to earnings (PE) ratios greater than 100. Today there are 80.

Dhandho update

Raised $152 million in 1st half of 2014

- Closed Stonetrust acquisition on 12/31/14

- $32.8 million cash + 220,000 units.

- Added $30 million in capital.

- Managing the Stonetrust Surplus and float.

Investment update

- Invested about $50 million in equities in 2015

- Took a hard look at several possible acquisitions but none were attractive

- Current holdings : cash + securities : $80+ million

New Ventures

- Exploring the launch of family of ETFs

- Dhandho has filed a patent related to “Smart Beta enhanced index investing”

- Exploring the start of a newCo Digital insurance agency and NewCo Insurance Co.

- Focus on small business Insurance

- Progressive/GEICO model in Comm. Insurance

- All the NewCo businesses will be Puerto Rico Corps.

- Risk

- New ventures have low capital downside, but intensive on effort involved.

- Hard to see losing more than $2 million before the business is scaled or abandoned.

Dhandho Holdings is a Puerto Rico Corporation

- Part of the USA; Significant Tax Benefits.

- Lower cost of operations.

- Abundant local talent available

Dhandho India started operations – Early days

- IT backend for NewCo and Stonetrust Insurance

- Reduce $30,000/month in IT consulting

- India Cost : about 1/3 rd

- Quant Analysis for NewCo and ETF Venture

- Acquired office space in Pune, India

IPO

- Too early to go IPO as businesses are growing and are at a early stage.

- Deferred for 2-3 years.

Questions & Answers

1. Consumers in U.S have stretched their replacement cycle for automobiles from 7 to 11 years. Can you please share your thoughts on demand for automobiles/cars in U.S and its implication to companies like GM and Chrysler ?

(Pabrai) The demand for cars in U.S should grow along with the population, unless there is a change in consumer behavior ( for example Uber changes the way we commute and travel ). On Average the auto sales has ranged between 15 to 18 million vehicles per year expect during the 2009 recession when it dipped to 10 million.

It would be reasonable to expect the auto sales to stay above 15-17 million range for next couple of years. The sales of trucks and SUV’s are also improving and will help GM and Chrysler.

Finally GM and Chrysler are global companies and have significant sales outside U.S. They will benefit from growth in demand in the U.S and across many other markets.

2. How do you value labor intensive businesses like auto/steel ?

(Pabrai) Labor costs are 5% of the price of a car. BMW manufactures cars in Germany, which is the highest labor costs environment in the world but they have the highest margins

Labor cost was not the defining factor for GM to go bankrupt, rather the defining factor was terrible products. However the product quality and offering of american manufacturers are comparable or better than other manufacturers for the first time in many years.

3. How will 30 million cash investment in Stone trust insurance by Dhandho holdings improve the intrinsic value and why hasn’t it resulted in improved underwriting profits ?

(Pabrai) StoneTrust’s growth in premium in the past 2-3 years did not match their growth in capital. Dhandho holdings infused capital into Stonetrust insurance to improve financial strength and meet rating requirements. However This investment will not be used in the business.

The infusion of capital to StoneTrust has nothing to do with underwriting profits. The underwriting profits or losses are coming from the dynamics of the business.

Stonetrust is very conservative in estimating loss reserves and we believe conservative reserves makes good business sense and has tax benefits.

4. Would you buy back share in Dhandho holdings before IPO to provide liquidity to shareholders ?

(Pabrai) None of the investors have approached us so far with a request to buy back shares so this is a hypothetical question. If there is such a request we have two options

- Approach new investors to raise capital

- Buy back shares to provide liquidity to investors

5. Can you share your thoughts on the nature of returns, what percentage can be attributed to change in earnings multiples compared to growth in intrinsic value ?

We invest in businesses based on our assessment of where it’s going rather than its current earnings, so to a great part our returns should track the growth in intrinsic value.

6. Can you share your thoughts on the strength of Horsehead’s balance sheet and its ability to withstand business cycles ?

(Robert Scherich, VP & CFO at Horsehead Corp)

- Horsehead is going through transformation

- We are in the process of de-risking our balance sheet and our focus is to maintain liquidity

- We are concerned about the commodity prices, but have hedged for the short term.

7. With easy access to information and decreasing attention span, do you expect the timing between super cycles or bubbles will shrink ?

(Pabrai) Historically bubbles are more frequent than we think. There is always a bubble forming is some corner of the world all the time.

The cause of these bubbles are usually local and peculiar to specific markets or nations. For example recently we saw a bubble deflate in the chinese stock market. There are many theories explaining the stock recent crash in the chinese stock market. Charlie Munger has a politically incorrect explanation.

According to Munger The chinese are on average better than the rest of us in math due to rice cultivation. Rice is difficult to produce compared to other crops and require lot more math skills during cultivation in order to calculate the requirements. So over thousands of years of evolution they ended up with better math skills. However due to their deep interest in math, they have developed an innate desire for gambling.

The chinese government has regulated gambling and hence the attention of the population shifted towards real estate/housing. After they realized that housing is not going up anymore, they shifted their focus to the stock market. The government also played a role in fueling this bubble with its policies encouraging investors to take on leverage and risk.

There are many such examples in the history of bubbles and crashes of stock markets across the world.

8. What books would you recommend to a 14 year old who is interested in investing ?

- Warren Buffett the making of an american capitalist by Roger Lowenstein

Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger by Peter D. Kaufman and Ed Wexler

Berkshire letters to shareholders ( Better than going to college )

9. What are your thoughts on GM – Chrysler merger ?

(Pabrai) Chrysler CEO, Sergio Marchionne is a poker player and he likes to play poker in real life as well. He is a tremendous manager and GM is the beginning of a poker game he is playing

If GM and Fiat merge, they are expected to have a cost savings in the range of 5 billion to 7 billion. The combined enterprise value of the company post merger will be in the range of 35 billion. The merger would also result in reducing the top 3 truck manufacturers to just 2 truck manufacturers.

I have observed that the rhetoric from Sergio goes up as the price of GM stock goes down, however we are not banking on the merger for our returns.

10. Is it prudent for individual investor to use moderate leverage ( e.g. 10% ) so that they are not forced out of their position in the event of a market crash but at the same time they can improve their returns by the use of leverage ?

It is better for individual investors to maintain a decent cash position and not invest 100% of their funds in the stock market.

Charlie Munger was asked similar question few years back, the question was

“How would I get rich fast”.

Munger’s answer to that question was that if you consistently spend less than you earn over a lifetime even with modest returns you will get rich.

The tendency to get rich faster ( specially with the use of leverage) is dangerous. The only time I would consider leverage in during deep crashes like 2008, but even there it is not necessary if you have cash reserves.

It makes no sense to risk any portion of your net worth even if the probability of losing it is remote. My recommendation is to never use leverage,

11. Is there a minimum ownership stake you would like to see the directors and executives have in a given company to make sure that their interests are aligned with the shareholders ? Do you prefer if they are options or direct purchases in the open market ?

We prefer if the management has ownership stake, however it is not a must. We have invested in companies where the management didn’t have significant ownership of the company’s stock. It’s a checklist item but not an absolute rule.

12. Can you please explain your process of evaluating a investment opportunity, specially from an individual investor’s perspective ?

The process is simple :

- Be a shameless cloner – Only consider investments of well respected investors

- Stay within your circle of competence

- Buy the company if it’s trading at half its intrinsic value.

23 Comments

Thank you for sharing! I was unable to attend and really appreciate your notes, best I have seen thus far!

Thanks for your kind words Jim.

thanks for the post, it encouraged me bought some Fiat Chrysler and Horsehead stock today. Pabrai is a highly regarded investor, I read his Dahandho investing book three years back. “Head you win, tail you don’t lose much”.

Manu, Glad you found my notes useful. Wish you the best with your investments.

Can you share what returns Prabai has had in 2014 at 2015 to date?

Unfortunately I can’t share the returns information. His overall returns over the years has been well documented on the internet

Happy Hour: Work Simply • Novel Investor

Very grateful for your excellent notes, Hari, thank you!

Thanks George, glad you found my notes useful

Hari,

Thanks a lot for taking the time to share your notes – very well done and very informative. I always look forward to your contributions to the investor’s podcast and the great information you’ve compiled here on BitsBusiness.

Keep up the good work – and thanks for all you do!

Thanks for your kind words Brent, glad you found my notes useful.

Thanks for sharing notes Hari.

Hi Hari, thanks for your kind words.

I admire Pabrai’s three investment guides:

1) cloning good ideas from best investors – I believe his PKX investment is a clone from Charlie Munger; I own PKX since 7/2014.

2) Insisting on “Margin Of Safety”, so that “Head you win, tail you don’t lose much”. In one his last year’s speeches, Pabrai calculated the intrinsic value of ZINC as $15. That is why I bought it on 9/25. The margin of safety is much higher now than last year.

3) check List filtering – I strongly believe FCAU has passed his Check List examination.

Hi Hari,

Did the CFO of Horseheads speak? If so what were his thoughts on the company. It seems to be trading like it’s going bankrupt. Any idea of the chances of such an outcome? Thanks.

Thanks for your comment Matt, Horsehead does have liquidity issues. Its debt are due soon and the management is confident they can work with the lenders to resolve the liquidity issues. The other issue is related to operational, specifically their ability to complete on-going expansion/construction of plants. Finally they are hit by the low commodity prices (including Zinc).

URL

where can I read Mohnish Pabrai’s shareholders letter? does he publish as Warren Buffet does?

Thanks,

Jay

Hey Jay,

I am not aware of a Buffet like letter from Pabrai. He might start doing it after Dhandho goes public.

Thanks

Hari

Hello Hari,

Thank you for the notes! would you be able to share how can one attend Pabrai’s meeting? is it only accessible for investors?

appreciate your response

Thank you

Hey Amey,

Thanks for the note, please contact the folks at Pabrai funds they should be able to help you. If you need more details please mail me at hari@bitsbusiness.com

Hello Hari,

Thank you so much for your notes.

Do you have any information regarding Pabrai Funds holding in South Indian Bank( listed on NSE &BSE). Has the fund reduced exposure to this stock in the Dec 2015 Quarter.

Best regards,

Revanth

Hi Revanth,

I am not sure about the current exposure of Pabrai Funds in South Indian Bank.

Thanks

Hari

Thanks a lot Hari, This was a great insight. Love your work