Lessons from 2019

— January 2, 20202019 was an interesting year in many ways. The year had no shortage of geo-political news and crisis, however the stock market remained benign. 2019 was also a good teacher. I am listing some of the key lessons I learnt from 2019 and also some of the books that helped me along the way. Look forward to your feedback and thoughts.

1. It builds character to sit on cash and do nothing

One of the defining characteristics of 2019 was the suspension of gravity for asset prices and the propensity of the central banks to levitate asset prices. In this environment we find ourselves with lot of cash or capital chasing few opportunities and nearly everything looks expensive by traditional measures yet they seem to climb the wall of worry to newer heights in their prices. Beating the fear of missing out (FOMO) and tolerating hit to your returns based on the principles you believe in is hard but it also tests your conviction.

One of the defining characteristics of 2019 was the suspension of gravity for asset prices and the propensity of the central banks to levitate asset prices. In this environment we find ourselves with lot of cash or capital chasing few opportunities and nearly everything looks expensive by traditional measures yet they seem to climb the wall of worry to newer heights in their prices. Beating the fear of missing out (FOMO) and tolerating hit to your returns based on the principles you believe in is hard but it also tests your conviction.

2. When you have a informed gut – act

Weather it’s investing or life when you form conviction based on your analysis and facts, there is always a voice in your mind that tries to instill doubts, I call it the doubting Tom inside your mind, which always drags you down to stay with the status-quo. In those time when you have a informed gut being dragged down by the doubting Tom, I found it to be beneficial to be on the side of your informed gut.

Weather it’s investing or life when you form conviction based on your analysis and facts, there is always a voice in your mind that tries to instill doubts, I call it the doubting Tom inside your mind, which always drags you down to stay with the status-quo. In those time when you have a informed gut being dragged down by the doubting Tom, I found it to be beneficial to be on the side of your informed gut.

3. It is hard to break your old ideas – but it’s necessary

Charlie Munger is a big proponent of the idea of discarding your best loved ideas in favor of new ideas that will help you to navigate the fast changing world. In Poor Charlie’s Almanac he is quoted as saying

If Berkshire has made a modest progress, a good deal of it is because Warren and I are very good at destroying our own best-loved ideas. Any year that you don’t destroy one of your best-loved ideas is probably a wasted year.

In that spirit one of my ideas or investing principle I departed from in 2019 was my views towards the yellow metal. As a disciple of Buffet-Munger and the value investing community, I naturally had a negative disposition towards gold, which is natural as Munger once called it the “a barbarous relic“. In 2019 I was fortunate to learn from some of the credible investors like Howard Marks and Ray Dalio. Both of them have a great understanding of history and view the current environment from a different lens than most of us (I have listed some of the books that helped me gain more perspective on gold and currencies below). I opened a non-trivial position in gold.

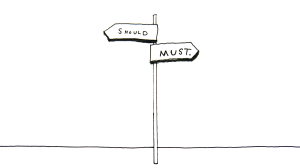

4. Making your decisions right is more important than making right decisions

We are our choices – Jean-Paul Sartre

One of the memorable quotes repeated by many successful people like Jeff Bezos is “We are our choices”, however I came across a lecture by Ajit Dovel, National Security Advisor to the Government of India, where he emphasized the idea of making your decisions right to be more important than making the right decisions. It does not mean one can be reckless in their decision making but his emphasis was on the concept of owning your decisions and personal responsibility. There were many situations in 2019 where I had doubts about the decisions I had made in the past, but the philosophy of owning your decisions and making them right gave me the strength to face the challenges boldly and decisively, hence making my decisions right, however some are still work in progress.

Books that shaped my thinking in 2019

Mastering The Market Cycle by Howard Marks is a fascinating analysis of the pendulum of investor psychology. It also provide a historical perspective on the investor behavior with illustrations, facts and anecdotes over decades. The message from the book can can be summarized as following

What the wise do at the beginning.. fools do at the end

The Rebel Allocator by Jacob L. Taylor is a gripping Novel with profound business principles wrapped in a moving narrative. The key takeaway for me from the book was the three straw approach a.k.a. The iron law of economic survival, which dictates the following

In order for a business to thrive, the value delivered to the customer (V) , has to be greater than the price the customers is charged (P), which has to be greater than the cost of the good or service (C)

In the recent past we have seen companies like WeWork, Uber struggle as they struggle to adhere to this iron law of economic survival.

The Big Debt Crises is a compilation of the research at Bridge Waters, which has helped them to navigate markets for decades and most recently the “Great Recession” of 2008. The book is instructive to understand the three major debt crises of the past 100 years: Weimar Germany 1918-24, the Great Depression 1928-1937 and the recent Great Financial Crisis of 2007-2011. Readers can learn from the mistakes and excesses of the past to help them navigate safely into the future.

Bob Iger opens his life and heart to his reader in this book, it is a tale of how great companies remain great over decades and generations and the personal sacrifices behind them. It is also a book that prescribes a formula for career success without compromising civility and decency.

Image credits

– elle luna @ medium.com

Leave a reply